Trump actually made good on one of his campaign promises, “no taxes on overtime.” Sort of.1 The otherwise Big Ugly Bill does not quite eliminate taxes on overtime, but it does allow some workers a modest deduction for overtime pay. This is a deduction from income taxes. “No taxes on overtime” does not mean Social Security, Medicare, or state taxes.2 Over the IAM’s objections, the final version of the bill exempted tons of workers. It also exempts tons of overtime situations. This has caused a lot of confusion on the deckplates, so I’m here to set the record straight.

Disclaimer: The purpose of this article is to demonstrate how needlessly complicated “no taxes on overtime” is. It reflects my best understanding of the current IRS guidelines and the Local S6 contract, but I am not an accountant. Don’t take anything I say as tax advice.

Key Takeaways

- The deduction for overtime pay applies to some Local S6 overtime, but not all Local S6 overtime. BIW must figure out how to track qualified and unqualified overtime by next year.

- You may only deduct overtime premiums. That’s the “half” in time-and-a-half. Only half of the double time premium, or one quarter of your total pay for double time, is deductible.

- Supervisors are not eligible to deduct any overtime pay.

- The maximum annual deduction is $12,500 (or $25,000 for joint filers). Most Local S6 members won’t hit this max.

- Unless Congress passes a law making “no taxes on overtime” permanent, 2028 will be the last tax year you can claim this deduction.

Breakdown with Examples

Local S6 members are eligible to deduct some overtime pay. Figuring out what overtime pay is complicated, and BIW’s payroll is not tracking it for you right now. According to the IRS, only “qualified overtime compensation” is eligible for deduction. Overtime pay only qualifies if it is required by the Fair Labor Standards Act (FLSA).3 The FLSA is the law that requires employers pay time-and-a-half for hours worked beyond 40 in any week.4 Our union contract goes above and beyond this minimum standard. The contract stipulates “time outside your regular shift” be paid at time-and-a-half.5 It doesn’t matter how many hours you actually end up working, as long as “you have accumulated a total of 40 hours in a week between time worked and excused absence codes.”6 This means you can take a vacation day on Monday (Code 15) and still get time-and-a-half for working a 6-hour shift on Saturday. Your “time worked” is only 38 hours in this example. The FLSA does not make BIW pay you time-and-a-half in this situation, but your union contract does. The overtime compensation from this example is non-deductible.

The difference between FLSA overtime and contractual overtime complicates things. Fortunately, the Big Ugly Bill includes a transition rule applicable for tax year 2025. The IRS has not yet released specific guidance on this rule, but it will allow BIW to “approximate a separate accounting of amounts designated as qualified overtime compensation by any reasonable method.”7 The union should be party to these approximations. Decisions about tax withholding procedures are a mandatory topic of bargaining.8 BIW and the union will have to figure out how to track qualified from unqualified overtime by next year.9

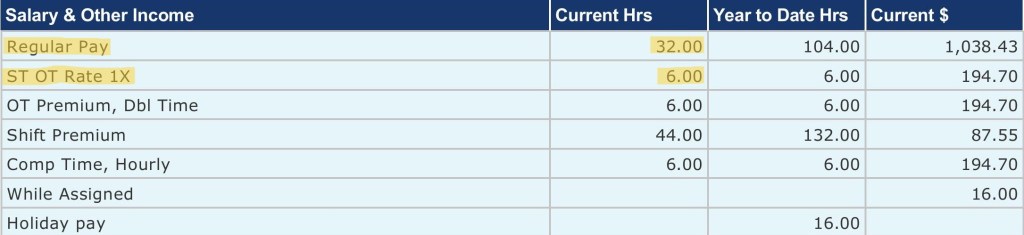

Your paystub can help you figure out what overtime will be deductible. Look at your paystub under “Salary & Other Income.” The rows labeled “Regular Pay” and “ST OT Rate 1X” tell you how many hours you worked. You are not eligible for any deduction unless total “Current Hrs” for these two rows exceeds 40. The above example comes from a paystub I received in January. I took Friday off for the Rosie the Riveter celebration, but I came into work Sunday. I still got double time, but the highlighted rows show how I only worked 38 hours. I will not be eligible to deduct this overtime from my income taxes.

I did work more than 40 hours one week in March. My “Regular Pay” and “ST OT Rate 1X” from the paystub below total 52 hours. The IRS says that I may deduct “the pay that exceeds [my] regular rate of pay – such as the ‘half’ portion of ‘time-and-a-half’ compensation – that is required by the Fair Labor Standards Act (FLSA).”10 The “half” in time-and-a-half and the “double” in double time are called “premiums.” BIW paystubs already separate premium pay from standard pay, labeled “ST OT Rate 1X.” The rows labeled “OT Prem, Half Time” and “OT Premium, Dbl Time” show premium pay. In the example below, I received 6 hours of time-and-a-half for Saturday and 6 hours of double time for Sunday. Only “Current $” from the rows labeled “OT Prem, Half Time” and half of “OT Premium, Dbl Time” are deductible. Only half of the double time premium is deductible because double time is not required by the FLSA.11 In this example, I am able to deduct $97.35 for Saturday overtime and $97.35 for Sunday ($194.70 ÷ 2 = $97.35). I will be able to deduct a total of $194.70 from my income taxes for this overtime week ($97.35 + $97.35 = $194.70).

Quick aside: Local S6 won an unprecedented midterm wage adjustment in 2022.12 Mechanics were suddenly making more than their supervisors. To incentivize more people to go salaried, BIW began paying frontline supervisors overtime. The FLSA does not require employers pay salaried supervisors overtime, though.13 This means supervisors cannot claim any deduction for their overtime hours. Supervisors aren’t paid an overtime premium, either. Supervisors receive straight time compensation for all hours worked. Even if they were eligible, there is no “half” in time-and-a-half to deduct from their income taxes.

The maximum annual deduction for overtime pay is $12,500, or $25,000 for joint filers.14 Most Local S6 members won’t come anywhere near this limit. My deduction for one week working Saturday and Sunday was just $194.70. I would have to work nonstop for more than 64 weeks to hit the $12,500 max. Claiming a deduction doesn’t mean getting that exact amount back as a refund, either. I will get to deduct $194.70 from my taxable income from this example, not my tax bill. Each week I work both Saturday and Sunday probably represents less than $50 in tax savings.15 This isn’t nothing, but I’d have to work myself to the bone to receive any appreciable tax break.

I was skeptical of Trump’s promise there would be “no taxes on overtime.”16 I still am. Trump doesn’t exactly have the best track record when it comes to campaign promises.17 The Big Ugly Bill does not make “no taxes on overtime” permanent. Unless Congress passes another law to enshrine the deduction, tax year 2028 will be the last time you can claim “no taxes on overtime.”18 Meanwhile, the Trump administration will continue to work on Project 2025. They’re already almost halfway there.19 One item left of the agenda proposes providing “flexibility to employers and employees to calculate the overtime period over a longer number of weeks.”20 Above, I demonstrated how the 40-hour requirement already limits what overtime I will be able to deduct from my income taxes. It doesn’t take much imagination to see how amending the FLSA could diminish an already insubstantial tax break. Take a vacation day at the beginning of the month, and pay for it in higher taxes at the end of the month.

No taxes on overtime is problematic for another reason, too. It leaves your tax break up to your employer. Article 3 of our contract gives management the right to “formulate overtime plans.”21 You can only work overtime if BIW offers it, leaving your tax break entirely up to management. At any employer, the availability of overtime depends on economic factors outside individual workers’ control. It’s not enough that you have the drive to put in more hours. More hours have to be available, too.

Overtime availability decreased in the month after Trump signed the Big Ugly Bill into law. Trump was really mad about the job numbers the Bureau of Labor Statistics released for July.22 Among other poor economic indicators, the report showed overtime in manufacturing decreased by an average of 2.8 hours a week.23 That’s 2.8 fewer tax deductible hours per week, cheapening an already cheap provision in the Big Ugly Bill.

I was surprised Trump’s Big Ugly Bill gave us anything, but nothing in it is worth $50 a week to me. (That’s $50 a week if management offers overtime and if I work all of it.) Even ordinary Republicans hate the Big Ugly Bill once they realize what’s in it.24 I know a lot of people were excited to hear the words “no taxes on overtime,” but Trump wasn’t serious about lowering your taxes. He could have proposed raising the standard deduction instead. This would have caused far fewer headaches, and it would have helped everyone.

This isn’t what anyone voted for, though. So here are some more examples of how “no taxes on overtime” will intersect with our contract:

24-Hour Sea Trial

Say you go on a 24-hour sea trial. When you return, management excuses you from work the next day to recuperate. You are still paid 16 hours of overtime, but you only worked 48 hours that week (40 + 16 – 8 = 48). You can only deduct 8 hours worth of the overtime premium. If you are a B Specialist brazer selected from the pipeshop, this is $135.84 ($33.96 × 8 × 0.5 = $135.84).25

July 29 Power Outage

Due to a power outage on Tuesday July 29, all second shift mechanics were sent home at 8:00 pm. They were excused from work. Any overtime they worked that week was still compensated at time-and-a-half or double time under our contract. Say I worked weekday overtime Wednesday through Friday, two hours each day. I was sent home four hours early on Tuesday, so I only worked a total of 42 hours (40 – 4 + 6 = 42). I will only be eligible to deduct two hours worth of the overtime premium. At grade 10, this is $xx.xx ($32.45 × 2 × 0.5 = $32.45).26

Taking FML

Say you have Family Medical Leave (FML). You call out Monday for a qualifying event. Later that week, you sign up for weekend overtime to make up for the missing pay. You work 6 hours both Saturday and Sunday. You still receive time-and-a-half for Saturday and double time for Sunday, but you only worked 44 hours (40 – 8 + 12 = 44). A Grade 9 P10 is paid $288.72 from overtime premiums in this scenario ($32.08 × (6 × 0.5 + 6) = $288.72) but can only deduct 4 hours worth, $64.16 ($32.08 × 4 × 0.5 = $64.16).27

Leaving Early

A second shifter signs up for Saturday overtime. The second shift gets out at midnight, and the 6-hour Saturday shift starts at noon. He wants a little more than 12 hours between shifts, so he takes 3 hours of vacation and leaves at 9:00 pm on Friday. He works a total of 44 hours that week (40 – 3 + 6 = 43). At Grade 5, he’s paid $83.49 for the “half” in time-and-a-half. ($27.83 × 6 × 0.5 = $83.49) but can only deduct 3 hours worth, $41.74 ($27.83 × 3 × 0.5 = $41.74).28

- Natalie Wu, “Trump’s ‘big beautiful’ bill promises no tax on tips and overtime, but there’s a limit—here’s who qualifies,” CNBC, July 9, 2025. ↩︎

- Jennifer Weiss, “No Tax on Overtime: W-2 Reporting Changes You Should Know,” HR Morning, July 8, 2025, accessed July 30, 2025. ↩︎

- IRS, “One Big Beautiful Bill Act: Tax deductions for working Americans and seniors,” fact sheet, accessed July 25, 2025. ↩︎

- DOL Wage and Hour Division, “Overtime Pay,” accessed July 30, 2025. ↩︎

- Agreement between Bath Iron Works and Local S6: August 21, 2023 to August 23, 2026 (Bath Iron Works, 2023), 18. ↩︎

- Ibid, 17; the only absence codes that do not count toward overtime compensation are 06, 11, and 12, personal business (PB), grace late, and suspension, respectively. For a list of excused absence codes: ibid, 73. ↩︎

- U.S. Congress, House, One Big Beautiful Bill Act of 2025, H.R.1, 119th Congress, became law, July 4, 2025. ↩︎

- Affirmed in arbitration between Local S6 and BIW, AAA Case No. 11 300 00893 00, March 5, 2003. ↩︎

- Jennifer Weiss, “No Tax on Overtime: W-2 Reporting Changes You Should Know,” HR Morning, July 8, 2025, accessed July 30, 2025. ↩︎

- IRS, “One Big Beautiful Bill Act: Tax deductions for working Americans and seniors,” fact sheet, accessed July 25, 2025. ↩︎

- Jennifer Weiss, “No Tax on Overtime: W-2 Reporting Changes You Should Know,” HR Morning, July 8, 2025, accessed July 30, 2025. ↩︎

- Memorandum of Agreement Between Bath Iron Works and Local S6: Mid-term wage rate adjustment (Bath Iron Works, 2022). ↩︎

- DOL, “Fact Sheet #17A: Exemption for Executive, Administrative, Professional, Computer & Outside Sales Employees Under the Fair Labor Standards Act (FLSA),” revised September 2019, accessed August 19, 2025. ↩︎

- IRS, “One Big Beautiful Bill Act: Tax deductions for working Americans and seniors,” fact sheet, accessed July 25, 2025; DOL, “Overtime Pay,” Wage and Hour Division, accessed July 25, 2025. ↩︎

- IRS, “IRS releases tax inflation adjustments for tax year 2025,” news release, October 22, 2024, accessed July 31, 2025. ↩︎

- “Trump promises to scrap all taxes on overtime if re-elected,” Al Jazeera, September 13, 2024. ↩︎

- “US election 2020: Has Trump delivered on his promises?” BBC, October 15, 2020; James Oliphant, “Trump and his campaign promises: Mapping his first 100 days,” Reuters, April 30, 2025, accessed July 31, 2025; Eunice Esomonu et al, “Tracking Trump’s presidential promises,” AP, last updated July 7, 2025, accessed July 31, 2025. ↩︎

- IRS, “One Big Beautiful Bill Act: Tax deductions for working Americans and seniors,” fact sheet, accessed July 25, 2025. ↩︎

- Project 2025 Tracker, accessed August 11, 2025. ↩︎

- Quoted in Lily Roberts, “Project 2025 Would Cut Access to Overtime Pay,” Center for American Progress, August 8, 2024, accessed July 31, 2025. ↩︎

- Agreement between Bath Iron Works and Local S6: August 21, 2023 to August 23, 2026 (Bath Iron Works, 2023), 4. ↩︎

- Christopher Rugaber and Josh Boak, “Trump removes official overseeing jobs data after dismal employment report,” AP, August 1, 2025; Ben Casselman and Tony Romm, “Trump, Claiming Weak Jobs Numbers Were ‘Rigged,’ Fires Labor Official,” The New York Times, August 1, 2025; Filip Timotija, “Who is Erika McEntarfer, labor statistics chief sacked by Trump,” The Hill, August 1, 2025. ↩︎

- BLS, “Employment Situation Summary,” news release, August 1, 2025. ↩︎

- Patrick Sullivan, “Ordinary Republicans Hate Trump’s “Big, Beautiful Bill” Once They Know What It Does,” interview by Michael Mechanic, Mother Jones, June 27, 2025. ↩︎

- Agreement between Bath Iron Works and Local S6: August 21, 2023 to August 23, 2026 (Bath Iron Works, 2023), 30; Ibid, 53. ↩︎

- Ibid, 30. ↩︎

- Ibid, 30. ↩︎

- Ibid, 30. ↩︎