On July 4th, Donald Trump signed his Big Ugly Bill into law, raising the federal debt limit by $5 trillion.1 The White House claimed:

President Trump’s plan doesn’t just grow the economy, it actually reduces the debt burden on future generations — something the D.C. establishment hasn’t done in decades.2

This statement is inconsistent with Trump’s record. In reality, the Congressional Budget Office estimates the bill will increase the deficit by nearly $3.3 trillion by 2034.3

The last time the United States ran a budget surplus was in 2001.4 George Bush’s wars put an end to the surplus. The 2008 financial crisis led to the deficit skyrocketing under Barack Obama.5 Although Obama made great progress reducing the national debt in his second term, he could not eliminate it. Trump immediately drove the deficit up again by giving tax cuts to his golf buddies. There was no way Joe Biden could lower the deficit in the aftermath of the covid-induced economic crisis of the 2020s. Then, Trump was elected (again) on the mistaken notion he would right the ship, even after he ran it aground the first time.6

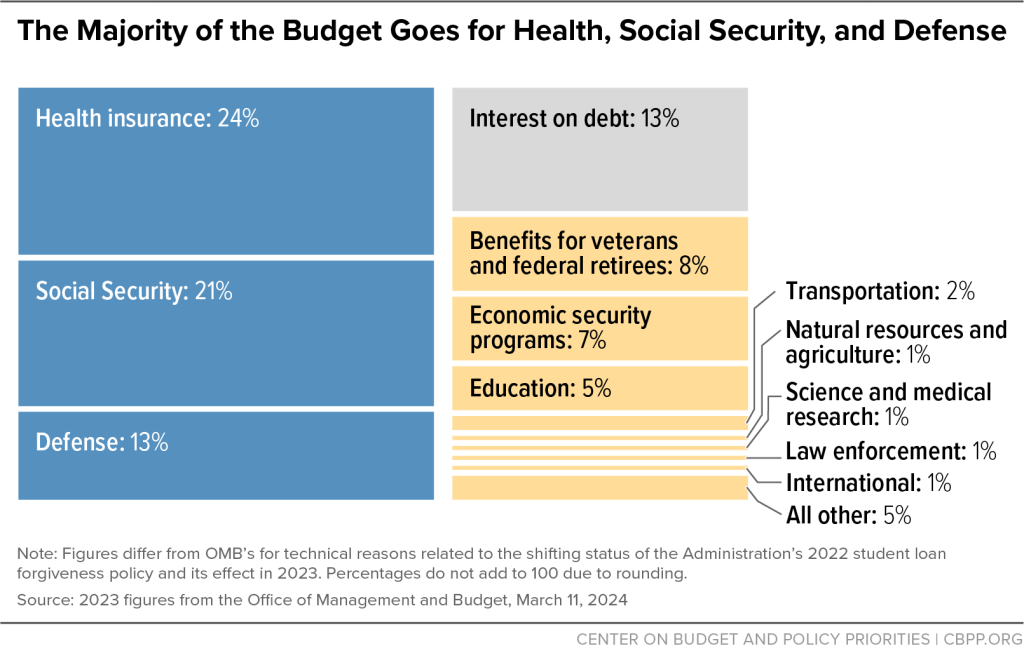

Running a deficit is exactly what Trump’s rich buddies want. The media has focused on tax cuts to the rich, but it’s actually far worse than just tax cuts. The United States spent $892 billion servicing debt in 2024. This represented 13% of the nation’s budget.7 That means that for every $8 in taxes you paid, some rich asshole collected $1 for his investment in America. Not only are rich people getting a tax cut, they’re getting paid for the privilege. The deficit effectively represents a negative income tax. Universal basic income for the rich.

The ethical implications of this are enormous. But the deficit hysteria that characterized Obama’s administration was disingenuous. It resulted from just one study by economists Carmen Reinhart and Kenneth Rogoff. After reviewing historic trends across the globe, they concluded that economies stall as soon as a nation’s debt hits 90% of its GDP.8 This means that for every dollar the nation produces, its government holds 90¢ in debt. Carmen and Reinhart’s findings were significant for Obama because in 2010 America’s debt-to-GDP ratio hit 91%. It reached 105% by the end of Obama’s second term and has since ballooned to 123%.9 The White House claims that this figure will decrease to 94% under the Big Ugly Bill.10

What does this mean for taxpayers? Trump’s 94% figure is still high by Carmen and Reinhart’s standards. Fortunately, their study was fundamentally flawed. Progressive commentator Bill Press explained:

Reinhart and Rogoff’s… study suffered from a simple Excel coding error that drastically changed the results when fixed. Instead of stagnating or shrinking as Reinhart-Rogoff claimed, economies with a 90 percent debt-to-GDP load grew at an average of 2.2 percent.11

Modest debt can actually stimulate the economy. This makes sense when you think about how credit scores work. Your score increases when you take on debt and pay it off. A higher score makes you more “credible” to lenders, enabling you to buy bigger at better rates. “Is this too much debt?” is not a very useful question in the abstract. A higher credit score gives you more options, but any specific loan needs judged on its own merits.12 Having a $300,000 mortgage is usually a better investment than a $30,000 car loan, even though it represents a significantly higher figure. Compare a $300,000 mortgage to a $60,000 income. The ratio is 500%, yet nobody cries about that.

The debt-to-GDP ratio is meaningless in isolation. When the government proposes taking on new debt, taxpayers must ask themselves what they are financing and whether it provides them value. Last year, Maine voters determined some debt was acceptable when they passed ballot referenda to authorize:

- $25 million in bonds for “research, development, and commercialization of Maine-based public and private institutions in support of technological innovation;”13

- $10 million in bonds for “the restoration of local community buildings;”14

- And $30 million in bonds for “the development and maintenance of outdoor trails.”15

Financing specific, high-cost but high-value projects is a sensible reason to take on debt. The alterative is a massive tax hike. This is where the ethical implications of debt come into play. The federal government does not use debt to finance big, high-value projects. It uses debt to fund day-to-day expenses like Bush’s forever wars, Obama’s healthcare, and Trump’s genocide. Feel free to disagree with me in how I characterize these specific policies, but my point remains. The government could finance day-to-day operations more efficiently by taxing the rich instead of paying them interest. Tax the rich, pay down the debt, and lower your taxes by 13%.

Instead, the Big Ugly Bill preserves high tax rates for working people. It continues to borrow money from the rich. Instead of taxing the rich, they are paid dividends. Whatever breaks the bill does give working people will not cancel out the cuts contained elsewhere in its approximately 870 pages.16 The Big Ugly Bill is complicated. The White House is not portraying it honestly when it says it provides “historic tax relief.”17

The only way to see anything in the Big Ugly Bill as a benefit is to take it out of context. Take a broader view of Trump’s policies. His tariff plan may represent the single largest tax hike on working Americans in history.18 No taxes on overtime is great, but it doesn’t make up for these new taxes.

Contrast the Big Ugly Bill with some commonsense legislation. In April 2024, Maine Public reported on a supplemental budget promising another $22.6 million for schools. But:

Even with those extra funds, many districts say they can’t keep up with rising costs, and are now looking at laying off educators and increasing local taxes to balance their budgets.19

Impossible costs meant increasing this year’s budget more than $1 billion, a 10% jump.20 Higher taxes on tobacco won’t be enough. Democrats in the Maine Legislature finally proposed a commonsense millionaire tax to fund education. The bill is only 3 full sentences. It concisely lays out a 4% tax on incomes over $1 million. It stipulates this revenue must be used to finance public education. All in less than half a page!21

We can eliminate the deficit, reduce federal debt, and tax everyone at a fair rate. It doesn’t have to be complicated. We can do all this without cutting healthcare and other social programs. The only program we need to cut is universal basic income for the rich.

- Alicia Parlapiano et al, “How Every Senator Voted on the G.O.P. Megabill,” The New York Times, July 1, 2025. ↩︎

- White House, “The One Big Beautiful Bill Slashes Deficits, National Debt While Unleashing Economic Growth,” news release, June 30, 2025. ↩︎

- Fatima Hussein, “Republican Senate tax bill would add $3.3 trillion to the US debt load, CBO says,” AP, June 29, 2025. ↩︎

- “Surplus or deficit of the U.S. government’s budget in fiscal years 2000 to 2029,” statistica, accessed July 10, 2025. ↩︎

- Bill Press, Buyer’s Remorse: How Obama Let Progressives Down (Simon & Schuster, 2016), 40. ↩︎

- “Surplus or deficit of the U.S. government’s budget in fiscal years 2000 to 2029,” statistica, accessed July 10, 2025. ↩︎

- “Policy Basics: Where Do Our Federal Tax Dollars Go?” Center on Budget and Policy Priorities, January 28, 2025, accessed July 1, 2025. ↩︎

- Carmen Reinhart & Kenneth Rogoff, “Why we should expect low growth amid debt,” Financial Times, January 27, 2010. ↩︎

- “What is the national debt?” fiscaldata.treasury.gov, accessed July 10, 2025. ↩︎

- White House, “The One Big Beautiful Bill Slashes Deficits, National Debt While Unleashing Economic Growth,” news release, June 30, 2025. ↩︎

- Bill Press, Buyer’s Remorse: How Obama Let Progressives Down (Simon & Schuster, 2016), 57. ↩︎

- “Policy Basics: Where Do Our Federal Tax Dollars Go?” Center on Budget and Policy Priorities, January 28, 2025, accessed July 1, 2025. ↩︎

- “Maine Question 2, Science and Technology Research and Commercialization Bond Issue (2024),” Ballotpedia, accessed July 9, 2025. ↩︎

- “Maine Question 3, Historic Community Buildings Bond Issue (2024),” Ballotpedia, accessed July 9, 2025. ↩︎

- “Maine Question 4, Development and Maintenance of Trails Bond Issue (2024),” Ballotpedia, accessed July 9, 2025. ↩︎

- Joseph Peterson, “Key Tax Impacts of the One Big Beautiful Bill Act for Individuals and Businesses,” Plunkett Cooney, July 9, 2025. ↩︎

- White House, “The One Big Beautiful Bill Slashes Deficits, National Debt While Unleashing Economic Growth,” news release, June 30, 2025. ↩︎

- Grace Abels, “Did Donald Trump impose ‘the largest tax hike in our lifetime’?” Al Jazeera, April 8, 2025. ↩︎

- Robbie Feinberg, “Maine schools say they’re facing a ‘perfect storm’ of expenses that are pushing up school budgets,” Maine Public, April 25, 2024. ↩︎

- Rachel Ohm, “Mills’ budget would increase cigarette tax, continue free community college,” Portland Press Herald, January 10, 2025. ↩︎

- Maine Legislature, “An Act to Permanently Fund 55 Percent of the State’s Share of Education by Establishing a Tax on Incomes of More than $1,000,000,” LD 1089, 132nd Legislature. ↩︎